NEWYou can now listen to Fox News articles!

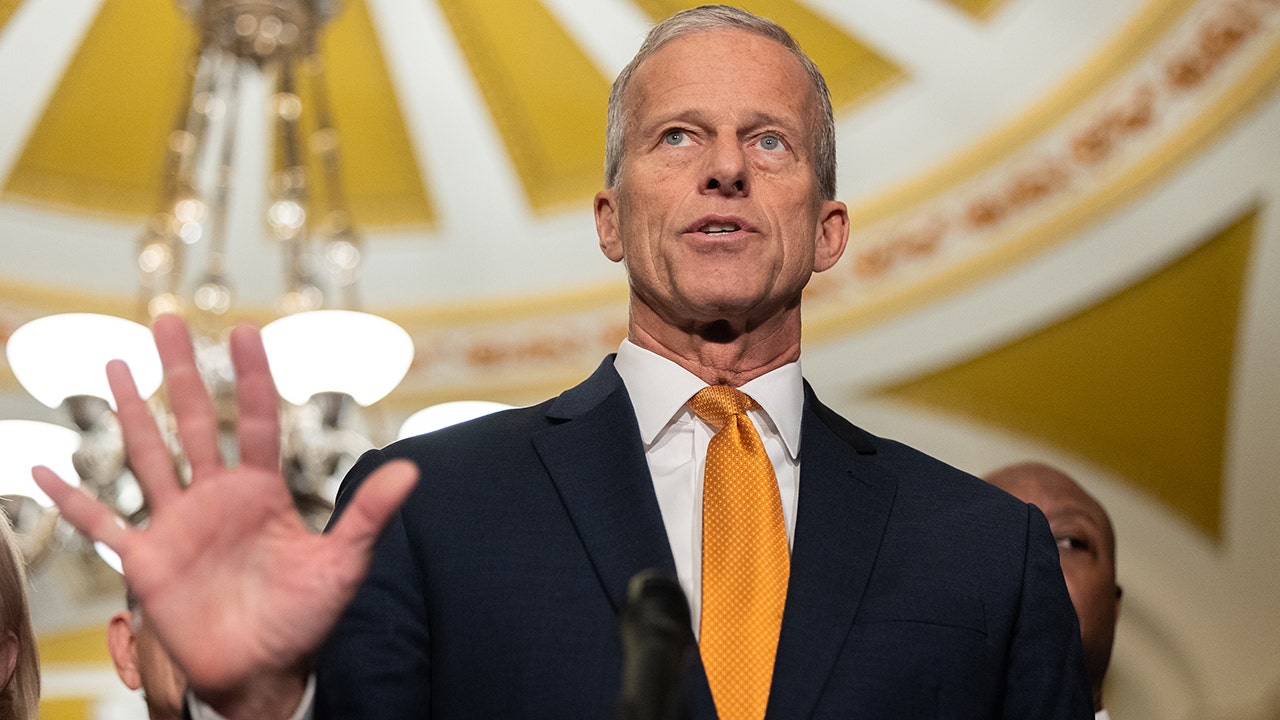

FIRST ON FOX: Republican senators are hitting the road to sell the Working Families Tax Cuts Act in meetings with local business owners and families, Senate Majority Leader John Thune highlighted.

More than a dozen senators, including Thune, have held events in multiple states during separate trips, including to Texas, West Virginia, Arkansas, Pennsylvania, Oklahoma, Nebraska, Ohio, Florida and Louisiana.

“When Joe Biden and Democrats had unified control of government, they created open borders and high prices,” Thune told Fox News Digital. “Republicans, on the other hand, have delivered safe streets, more money in pockets, and new opportunities to get ahead through the historic Working Families Tax Cuts.”

“Now we need to make sure the American people know it. Republicans will be hitting the ground hard in 2026 to sell our accomplishments and continue building on our work with the Trump-Vance administration to create a safe, strong, and prosperous America,” Thune added.

BIG BEAUTIFUL BILL IMMEDIATELY HITS THE CAMPAIGN TRAIL IN BATTLE FOR CONGRESS

The GOP senators who have held events are John Cornyn of Texas, John Barrasso of Wyoming, Bill Cassidy of Louisiana, Jim Justice of West Virginia, Pete Ricketts of Nebraska, Shelley Moore Capito of West Virginia, John Boozman of Arkansas, Dave McCormick of Pennsylvania, Dan Sullivan of Arkansas, James Lankford of Oklahoma, Katie Britt of Alabama, Ashley Moody of Florida, Jon Husted 9of Ohio and Rick Scott of Florida.

Senate candidates Mike Rogers and Michael Whatley also joined Thune, Cornyn, Barrasso and Husted during a trip to the southern border in early January to see progress made on improving national security. The Working Families Tax Cuts Act, also known as the One Big Beautiful Bill Act, included a roughly $165 billion investment for immigration and border security efforts, including $46.5 billion for funding for the border wall.

Other senators met with local businesses in their respective states to discuss how the bill could benefit local communities.

BESSENT BLASTS DEMOCRAT-LED STATES FOR BLOCKING TRUMP TAX RELIEF IN OBBBA

“This week, I visited Kamp A Demics Learning Center, one of Montgomery’s child care centers, where I toured the facility and read to some of the precious children,” Britt posted to X. “I also participated in a roundtable discussion on the updated child care tax credits I secured in the Working Families Tax Cuts Act and my continued work to address our child care crisis.”

“I’m grateful for the opportunity to speak with restaurant owners and community leaders about Republicans’ Working Families Tax Cuts Act—a law that will eliminate taxes on tips and overtime,” Husted posted to X with photos highlighting the event that took place in Ohio.

The bill passed the Senate on July 1, 2025, and Trump signed it into law on July 4, 2025.

THE BATTLE OVER THE ‘BIG, BEAUTIFUL BILL’ MOVES FROM CAPITOL HILL TO THE CAMPAIGN TRAIL

The Tax Foundation estimates that the legislation includes $3,752 in tax cuts for the average taxpayer in the U.S. in 2026, with the highest savings in Teton County, Wyoming seeing an estimated $37,373 per taxpayer in 2026.

The basis for the tax cuts come from an extension of provisions in the Tax Cuts and Jobs Act, which was signed into law by Trump during his first term. The TCJA doubled the standard deduction for single and married jointly filing households, and reduced income tax rates, with the top rate falling from 39.6% to 37%.

The One Big Beautiful Bill Act (OBBBA) also extended a Child Tax Credit that was part of the TCJA, which reduces how much income tax a family owes for each qualifying child, up to $2,000 per child, per year.

CONGRESS DELIVERS ONE BIG, BEAUTIFUL WIN FOR THE MIDDLE CLASS

Thune joined Cassidy at a restaurant in Louisiana to talk with servers and employees about how the “no tax on tips” portion of the OBBBA would put more money in their pockets.

The main portion of the OBBBA that is new from the TCJA extensions excludes qualified tip income from federal income tax up to $25,000 per year, and excludes qualified overtime income from federal income tax up to $12,500 for single filers and $25,000 for marriages filing jointly. Payroll taxes still apply to tips and overtime, and benefits will eventually be phased out in 2028.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Critics of the legislation point to a reduction in federal income, thus increasing national debt in the short term, and the shifting of Medicaid costs to states rather than the federal government.

The Tax Foundation also estimates that the bill will create roughly 938,000 full-time equivalent jobs over the long run.

Preston Mizell is a writer with Fox News. Story tips can be sent to [email protected] and on X @MizellPreston

Read the full article here