New York

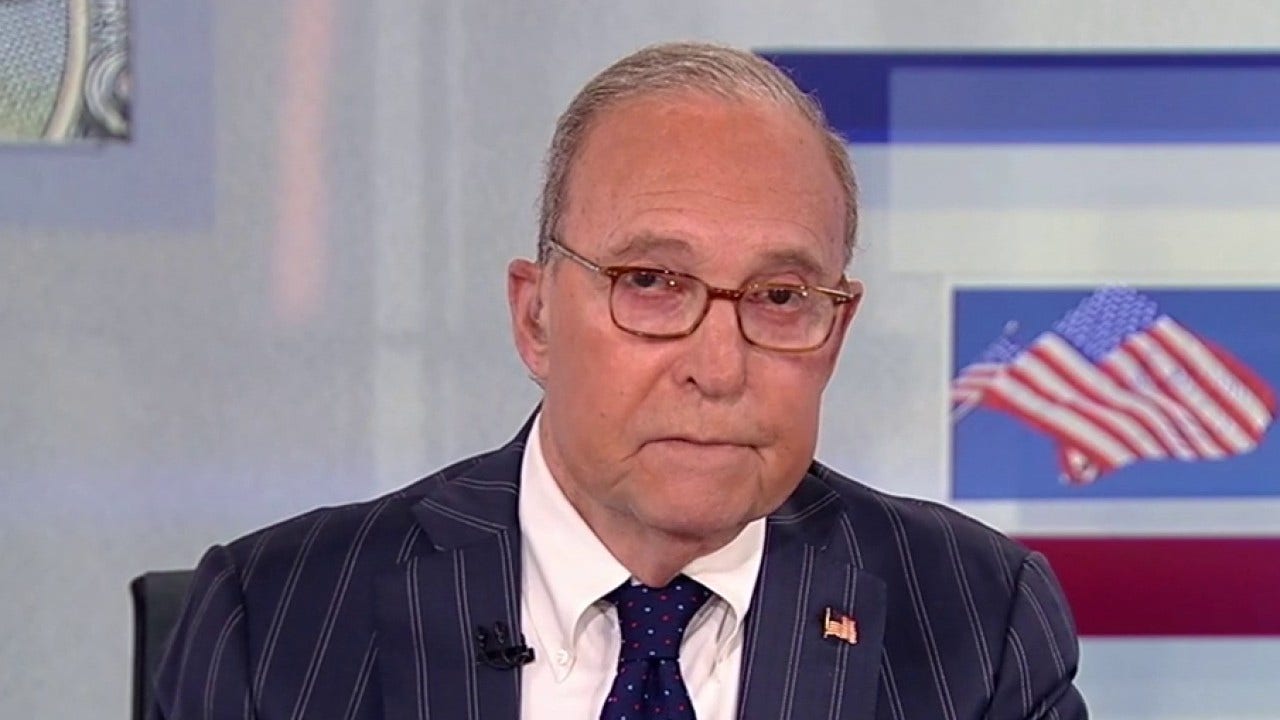

When many were celebrating the remarkable economic recovery from the pandemic in the spring of 2021, Larry Summers warned the White House and the rest of Washington that inflation was a real danger.

That warning proved to be prescient. Price spikes engulfed the US economy, crushed consumers and forced the Federal Reserve to spike interest rates to multi-decade highs. Inflation became issue No. 1 for voters and helped send Donald Trump back to the White House.

Now, with many celebrating the apparent defeat of inflation, Summers is delivering another warning to Washington.

Summers, the famed economist and former Treasury secretary, cautioned Tuesday that the inflation genie may not be back in the bottle. And, most tellingly, his warning doesn’t even account for what he fears could be a very inflationary agenda from the incoming Trump administration.

“My own judgement is that the Fed and markets are still underestimating the overheating risk,” Summers said during a conversation hosted by the New York Economic Club. “I ask myself: Why is cutting rates a priority into that environment?”

The former Obama and Clinton official pointed to above-target core inflation (a metric that strips out volatile food and gas prices), a rapidly growing economy and financial markets that are “on fire.”

The Federal Reserve cut interest rates last week for the second consecutive meeting and signaled more cuts could be on the way.

The former Harvard president suggested the Fed could be repeating the “astonishing” and “huge error” of 2021 when, in hindsight, it was very late to respond to soaring prices by raising rates.

“I am fearful that the Fed is going to be more like once burned, twice burned, rather than once burned, twice shy, on inflationary risks,” Summers said.

Of course, prices are no longer skyrocketing as they were during the early months of the Biden administration. And job growth has fallen off significantly in recent months. Rate cuts could help reignite the labor market.

Consumer prices increased 2.4% in the 12 months ended in September, according to the Bureau of Labor Statistics. That is down sharply from the mid-2022 peak of 9% when gas prices spiked above $5 a gallon.

Forecasters expect Wednesday’s consumer price index to show the inflation rate accelerated in October to 2.6%.

After presiding over another rate cut last week, Fed Chair Jerome Powell argued that inflation is on a “sustainable path back” to the central bank’s 2% goal. However, Powell acknowledged during the press conference that more work is needed.

“The job’s not done on inflation,” Powell said.

Like other mainstream economists, Summers expressed concern that President-elect Donald Trump’s campaign promises could reignite inflation.

“There is a very substantial risk that the president will attempt to implement what he talked about. If he does, the consequences are likely to be substantially greater inflation than what was set off by the excessive Biden stimulus,” Summers said.

In particular, Summers cautioned that if tariffs are used aggressively, instead of just threatened as leverage to make trade deals, there would be a “substantial adverse supply shock from higher prices.”

Trump has also promised to enact the largest deportation program in American history, deporting millions of undocumented people – many of whom are working.

Summers said that while work must be done to address the border, deporting millions of workers runs a “substantial risk of a labor shortage, which in turn is an inflationary force.”