The European Union has agreed to indefinitely immobilise the assets of the Russian Central Bank, a central element of the reparations loan to Ukraine, still under intense negotiations ahead of a make-or-break summit next week.

By doing so, the EU locks in the assets under its jurisdiction for the foreseeable future amid fears that the United States might seek control of the Russian funds and use them in a future settlement with Moscow to end the war.

The long-term immobilisation was agreed by ambassadors on Thursday afternoon under Article 122 of the EU treaties, which only requires a qualified majority from member states and bypasses the European Parliament.

The law prohibits the transfer of the €210 billion in assets back to the Russian Central Bank. The bulk of the assets, €185 billion, is held at Euroclear, a central securities depositary in Brussels. The remaining €25 billion is kept in private banks.

Until now, the funds have been immobilised under a standard sanctions regime, which depends on unanimity from all 27 and is vulnerable to individual vetoes.

But last week, the European Commission pitched to invoke Article 122 to keep the assets away from Russia for the foreseeable future. Article 122 has been previously used to cope with economic emergencies, such as the COVID-19 pandemic and energy crisis.

In a novel interpretation, the Commission argued that the shockwaves unleashed by Russia’s full-scale invasion of Ukraine have caused a “serious economic impact” for the EU as a whole, triggering “serious supply disruptions, higher uncertainty, increased risk premia, lower investment and consumer spending”, as well as countless hybrid attacks in the form of drone incursions, sabotage and disinformation campaigns.

“Preventing that funds are transferred to Russia is urgently required to limit the damage to the Union’s economy,” the proposal said in its introduction.

Under the ban, the €210 billion will be released when Russia’s actions “have objectively ceased to pose substantial risks” for the European economy and Moscow has paid reparations to Ukraine “without economic and financial consequences” for the bloc.

A new qualified majority will be required to trigger the release.

“Article 122 is essentially about putting the immobilisation of the assets on a more sustained footing so as not to roll over the immobilisation every six months,” a senior diplomat said on Thursday, speaking on condition of anonymity.

“The European Council already decided that this needed to be done – that the assets should remain immobilised until Russia has paid war damages – so you could say the decision based on 122 is an implementation of that decision of the European Council.”

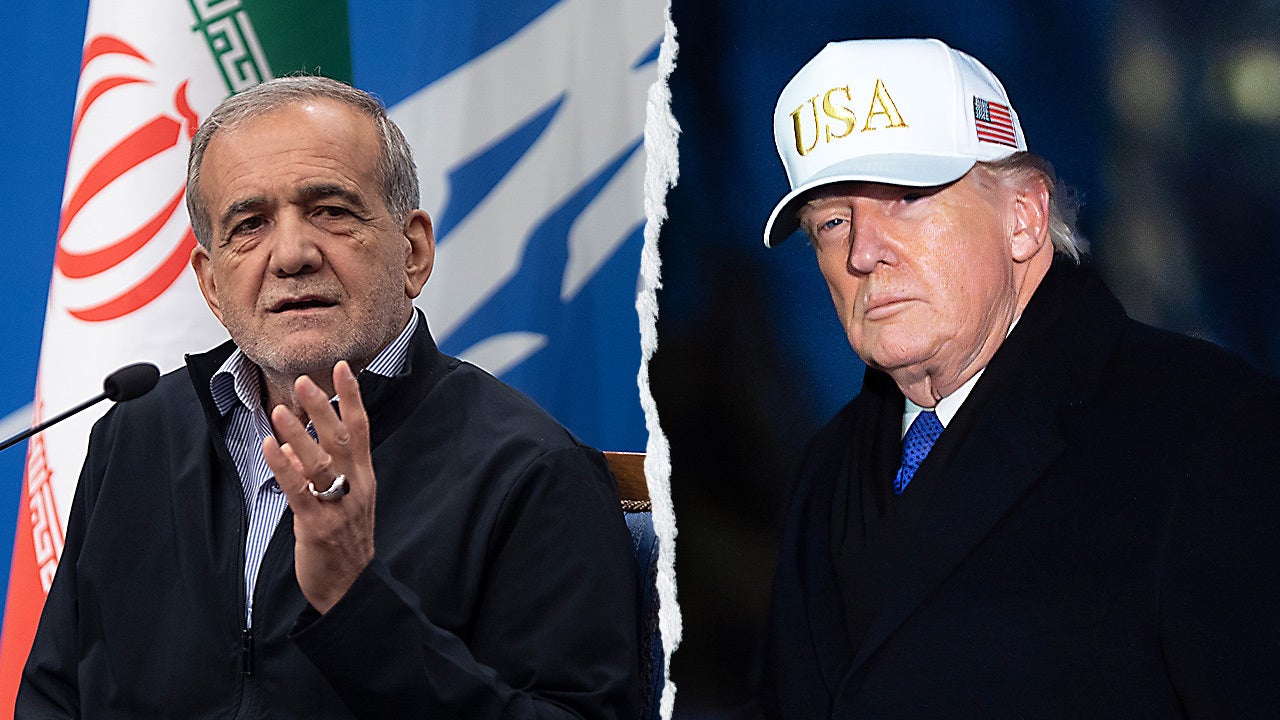

Pushing back against Trump, shielding Kyiv

Last month, Europeans found out from media reports that the Trump administration and the Kremlin had drafted a 28-point plan to end the war in Ukraine. Point 14 of the plan said the Russian assets should be used for the commercial benefit of both Washington and Moscow, a contentious idea that Western allies quickly shot down.

By locking the assets through a qualified majority, the EU is immediately in a stronger position to resist external pressure and prevent undesirable vetoes. (The US has been vague on whether it wants the bloc to move forward with the reparations loan.)

The long-term ban is an important pillar of the Commission’s proposal to channel the Russian assets into a zero-interest reparations loan to support Ukraine, which Belgium, as prime custodian of the funds, continues to fiercely resist.

Ambassadors are currently going line by line through the legal texts and have discussions scheduled for Thursday, Friday and even Sunday.

The goal is to resolve as many questions as possible before EU leaders gather for a make-or-break summit on 18 December, when they will decide how to raise €90 billion to meet Ukraine’s budgetary and military needs for 2026 and 2027.

Belgium has filed dozens of pages of amendments to the legal texts, according to diplomats familiar with the process. The amendments, which are not public, complicate what was already a highly complex and sensitive file.

On Wednesday, Belgian Prime Minister Bart De Wever cast doubt over the suitability of Article 122 and the existence of an economic emergency to justify its activation.

“This is money from a country with which we are not at war,” De Wever said, speaking to reporters at the Belgian parliament. “It would be like breaking into an embassy, taking out all the furniture, and selling it.”

In response to the criticism, a Commission spokesperson said that it was “reasonable” to argue that Russia’s war has gravely endangered the European economy as a whole and that, as a result, Article 122 was an appropriate legal basis.

“If you look at how the situation would be without the war, you would certainly see a more prosperous economic situation in Europe,” the spokesperson said.

The three conditions

Though Belgium makes no secret of its aversion to the reparations loan, it is willing to give its blessing if three key conditions are met, De Wever said on Wednesday.

The first condition is the full mutualisation of risks by all member states.

The Commission has proposed to split guarantees into two tranches of €105 billion each to cover the €210 billion in Russian assets held on EU territory. However, Belgium seeks greater coverage against any potential eventuality, such as judicial awards.

Privately, diplomats say the coverage might exceed €210 billion and be combined into one single tranche to allay Belgian concerns. But the prospect of granting open-ended guarantees, which De Wever appears to favour, is considered unfeasible.

The second condition is liquidity safeguards for Euroclear, the Brussels-based institution that holds €185 billion of the immobilised Russian assets. Belgium is worried that, if the assets are released prematurely, Euroclear will be unable to honour its legal claim with the Russian Central Bank and be held liable for breach of contract.

Now, the ban under Article 122 makes the premature release virtually impossible.

As an extra safeguard, the Commission says it will lend money to member states that struggle to rapidly raise the cash for their guarantees, if these are activated. (The European Central Bank has firmly declined to provide this liquidity backstop.)

The third condition from Belgium is complete burden-sharing, which means pooling the €185 billion in assets held at Euroclear and the €25 billion held in private banks in France, Germany, Sweden and Cyprus, as well as Belgium.

While the Commission’s proposals seek to mobilise the entire €210 billion pot, it remains unclear how much France, which holds an estimated €18 billion, is willing to play along. Privacy and secrecy are sacrosanct principles in the banking sector.

The Élysée did not reply to an Euronews request for comment.

De Wever warned on Wednesday that if these three criteria are not met and the EU moves ahead with the reparations loan anyway, Belgium will mount a legal challenge.

“If a decision is taken which I believe is manifestly at odds with legality, which does not make sense and which involves very great risks for this country, then you cannot rule anything out,” the premier said.

On Thursday, his budget minister, Vincent Van Peteghem, said the country would be “very constructive” in the talks but would not accept “any reckless compromise”.

Diplomats admit that overriding Belgium to approve the loan with a qualified majority would be politically unsustainable. Should the Belgian reservations prove impossible to address at the upcoming summit, the bloc will try to issue €90 billion in joint debt – a Plan B that Hungary will be certain to derail.

This article has been updated.

Read the full article here