Published on

Have you seen this precious metal recently? After hitting a record high, gold plummeted, suddenly losing nearly 15% of its value. Silver did even worse, crashing by more than 30%. Ouch.

So what caused the crash? Markets are reacting to US President Donald Trump’s latest nominee for the Federal Reserve chief, sparking fears that interest rates might stay higher for longer.

But despite this crash, Europe is still hoarding gold. But why?

Let’s start with central banks. They buy gold to reduce reliance on the US dollar and to stabilise national economies. And they buy a lot.

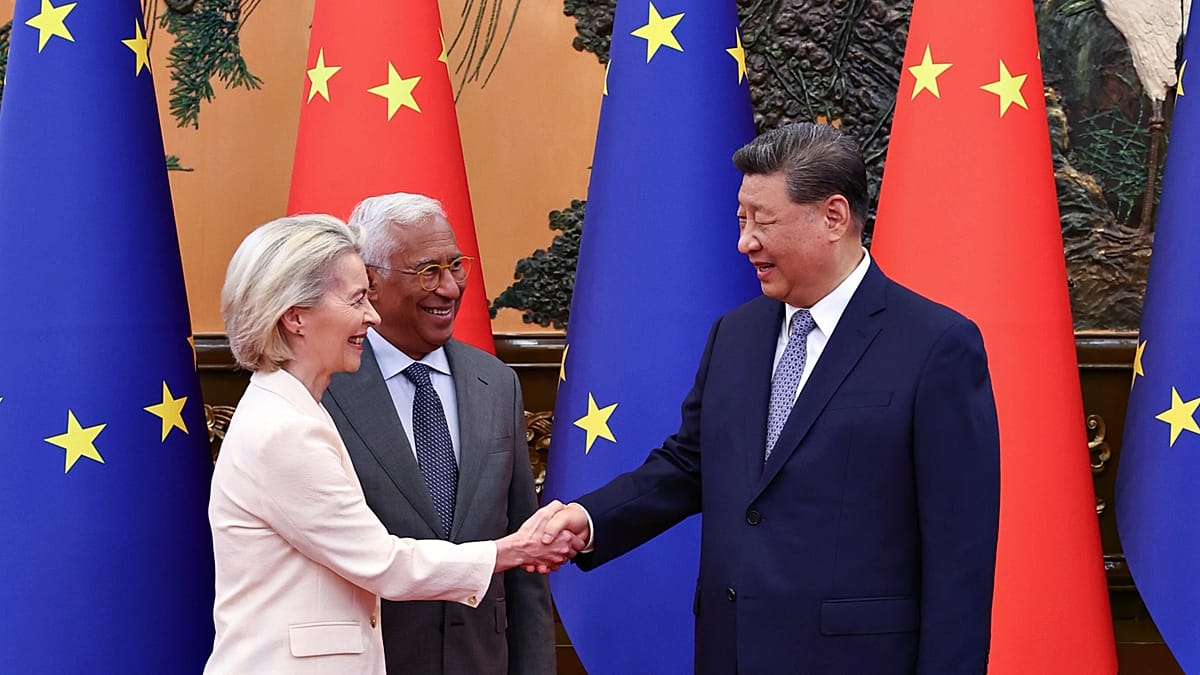

Take Portugal as an example. Lisvon hold almost 400 tonnes. Then, there is Poland. With Russia’s war in Ukraine, Warsaw has been on a buying spree, now holding 550 tonnes.

And that is already more than the European Central Bank itself.

And finally, Germany. It owns over 3,000 tonnes, but with 1,200 sitting in New York. And with Trump back in power, German politicians are demanding: “Bring our gold home.”

That’s Europe. And what about Europeans?

Gold is seen as a shield, protecting your savings as the value of paper money declines over time. Do you remember when your espresso cost you €1? Good luck getting one at this price in Brussels today.

But as recent days showed us, it does not always have the Midas touch.

Finally, why does your reporter buy gold? Because even if its price falls down… I still have something shiny to play with. As opposed to crypto.

Watch the Euronews video in the player above for the full story.

Read the full article here