SAN JOSE, Calif. — When it’s time to pay a bill, many people still write a check and mail it. But is that safe anymore? Postal inspectors say mail theft is rising fast — and thieves are going after your checks.

The phrase “the check is in the mail” has new meaning for two northern California homeowners who were among the latest to pay the price of mail theft. They dropped their property tax payments in the mail as usual. And the checks were cashed right away — but not by the tax collector.

Kathy Pham of San Jose was surprised to get a delinquency notice in the mail saying she never paid her property taxes.

She thought, sure she did.

“I thought, ‘Oh my gosh. Did I forget?’ I was like kicking myself,” Pham said. “My husband actually took the check down to the post office and dropped it off.”

In fact, her bank statement showed that the check had cleared months ago.

“I said I’m going to go to the county Monday, and I’m going to tell them, ‘Hey, you cashed my check.’ And then my husband said, ‘Hey, let’s look at the check.’ And that’s when I almost fell over,” she said.

MORE: Santa Cruz woman falls for gift card scam, but takes quick action and gets her money back

The check image showed a very different check than the one Pham wrote.

Criminals had stolen it from the mail, then used a pen to squeeze letters between the ones Pham wrote to form a new name.

“They just — they kind of fit their name into those letters,” Pham said.

That person cashed her check, making off with her $2,400.

“Not only did I have to pay the property tax again, I paid, like, all that late fees,” she said.

Pham went right down to Wells Fargo Bank. Surely her bank would refund her money.

“They denied it because I waited too long,” she said.

The same thing happened to Jody Glaser of Los Altos and her husband, Paul.

They dropped their property tax payment into a blue mailbox outside the post office. Three months later, they got a late notice from the county.

“I was in the other room, and I heard him say ‘Baaaah,'” said Jody Glaser.

MORE: Bay Area software rep. lost $176K of savings after accepting remote job she thought to be with FB

“I’m like, I know I paid it. I know I saw that the check hit the account,” said Paul Glaser.

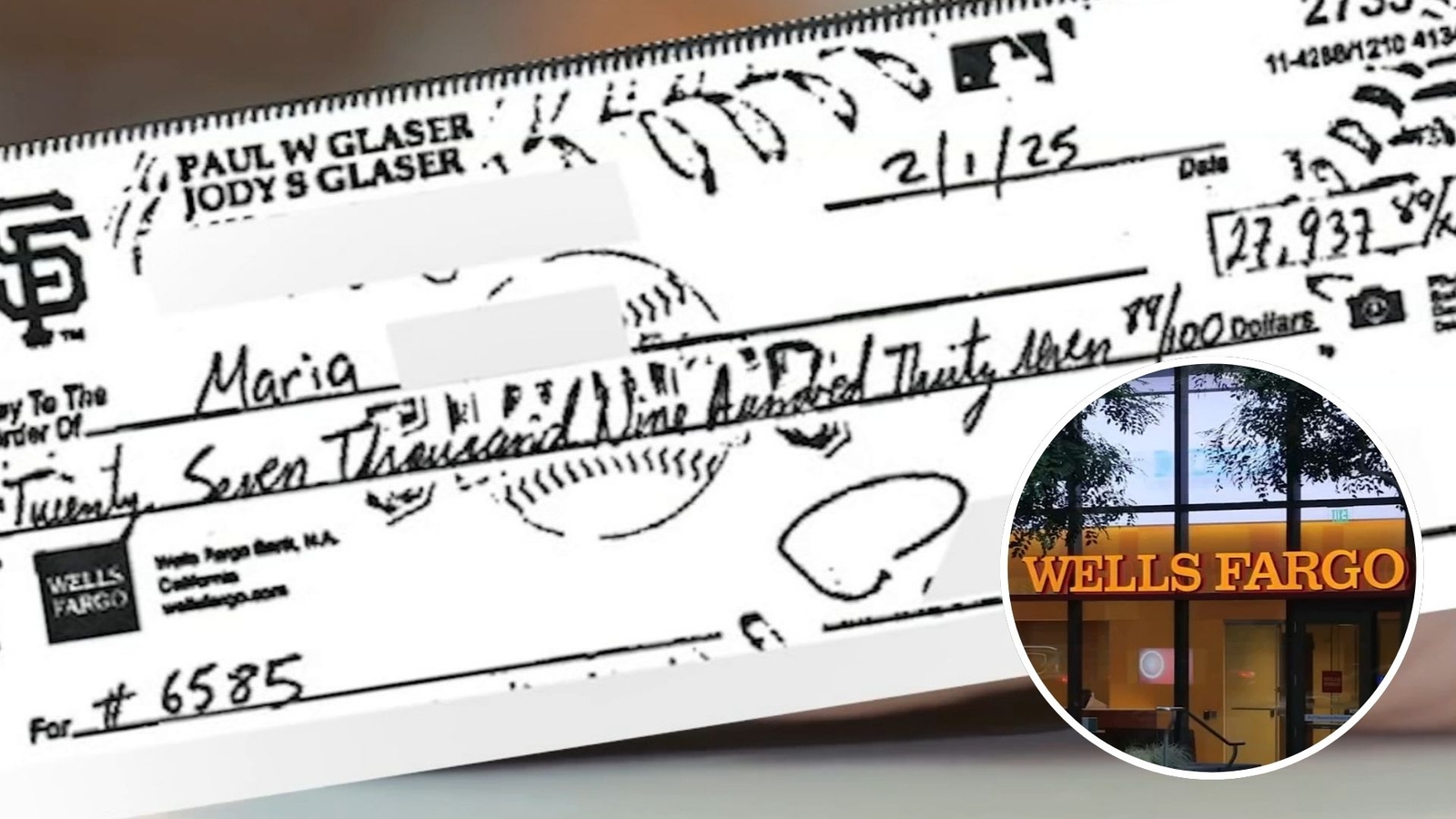

So they clicked on the check image, only to see a big shock.

“Clearly, the check had been altered, and cashed by somebody else,” Paul said.

“The criminals probably know there’s a chemical that will wipe away the ink,” Jody said.

To their surprise, the check image showed somebody had wiped off the name of the tax collector and put in a different name.

“And it was a woman’s name, obviously not the tax board,” Jody said.

The thief took nearly $28,000.

And the couple still had to pay their property taxes — plus penalties. Another $30,000.

“And so now we’re out, you know, $60,000,” Jody said.

They went to their bank — also Wells Fargo — expecting a refund.

“We, within 30 days, got an automated denial,” she said. “They said you have to notify us within 30 days of the statement.”

“Same thing,” said Kathy Pham. “‘Your claim was denied because you waited too long’ I went in as soon as I found out, so how can you say I waited too long?”

Wells Fargo pointed to its 42-page deposit account agreement, which says customers must review bank statements each month and report unauthorized payments within 30 days — or lose rights to a claim.

But the homeowners say they did review their statements, and they didn’t show any fraud.

“The statement only shows the date and the amount,” Jody said. “It doesn’t show who you wrote the check to. It doesn’t say who cashed the check.”

It just says “check.”

As a result, they had no idea it was scammers who cashed their checks until the county sent delinquency notices three months later.

“The only way we would know is if we had downloaded the actual check. Who does that? I mean, you would have to do that for every single check,” Jody said.

But Wells Fargo says that’s exactly what customers should do. The bank updated its account agreement last November to say customers must also review check images to preserve rights to a claim. That explicit clause was not in the agreement when the Glasers and Kathy Pham filed their claims. But Wells Fargo said check images were always available to them.

In a statement, Wells Fargo said:

“We empathize with our customer’s situation. We never want to see anyone experience a financial scam or fraud. Our priority is to support our customers and raise awareness for them to avoid, detect, and promptly report incidents so we can act quickly together.”

Consumer advocate Teresa Murray of the U.S. Public Interest Research Group says customers may not realize state law requires them to report altered checks in a “reasonable time.” Banks usually allow 30 to 60 days.

And it’s up to consumers to be vigilant.

“I’m sure that a lot of people do not read all of the terms and conditions and the, you know, all of the fine print when they open a checking account,” Murray said.

“We live in a society now where honestly, we as consumers, we have to be our own best advocate. We can’t count on anybody else to take care of us,” Murray continued. “There are lots of bad guys out there, a lot more technology. It’s just super easy for people to get ripped off. And by the time that somebody realizes something’s wrong, you know, the bad guy is long gone, long gone, and somebody is left holding the bag.”

“So we learned our lesson. Do not pay a big bill like that in the mail,” said Jody Glaser.

Turns out a thief deposited the Glasers’ nearly $28,000 check into an ATM at a U.S. Bank in Minnesota.

And the mailbox where they dropped their check? It was sealed off and put out of service, due to many thefts at that box. A sign on the box says: “Please drop mail inside the post office.”

Pham was told the thief cashed her check at a Wells Fargo branch in South San Francisco.

But, for her, there was a happier ending. After our sister station KGO-TV encouraged her to appeal, Wells Fargo did refund Pham’s money.

“It was a big relief,” she said.

The bank did not say why it refunded Pham, but not the Glasers, citing privacy rules. But in a letter to the couple, Wells Fargo said it would continue trying to recover their funds.

“Some random person stole the check, easily changed the name, and cashed it, and the bank is saying it’s on us. That could happen all the time. I mean, that’s huge. Like, that is a huge, huge, huge problem,” Jody said.

“Yeah, I’m so traumatized. I don’t think I’m (going) to be writing a check in a while,” Pham said.

Experts say mail thieves look for envelopes that may contain a check, like utility bills and even birthday cards. They knew blue envelopes contained those Santa Clara County property tax payments.

Consumers should also watch out, because once a thief gets your check, they also have your bank account number and a whole lot of your personal information. To avoid risks, you can pay your property taxes and a lot of other bills electronically.

© 2026 KGO-TV. All Rights Reserved.