Black Friday 2024 has finally arrived, and as shoppers across the country spend hours sweeping through online and in-store deals, many Americans may not be familiar with the dark and criminal history of the day that spans back centuries.

“The original term Black Friday actually comes from Sept. 24, 1869,” financial adviser Bryan Kuderna told Fox News Digital. “What happened on this day was a very famous market crash … where in one day, the stock market dropped over 20%.”

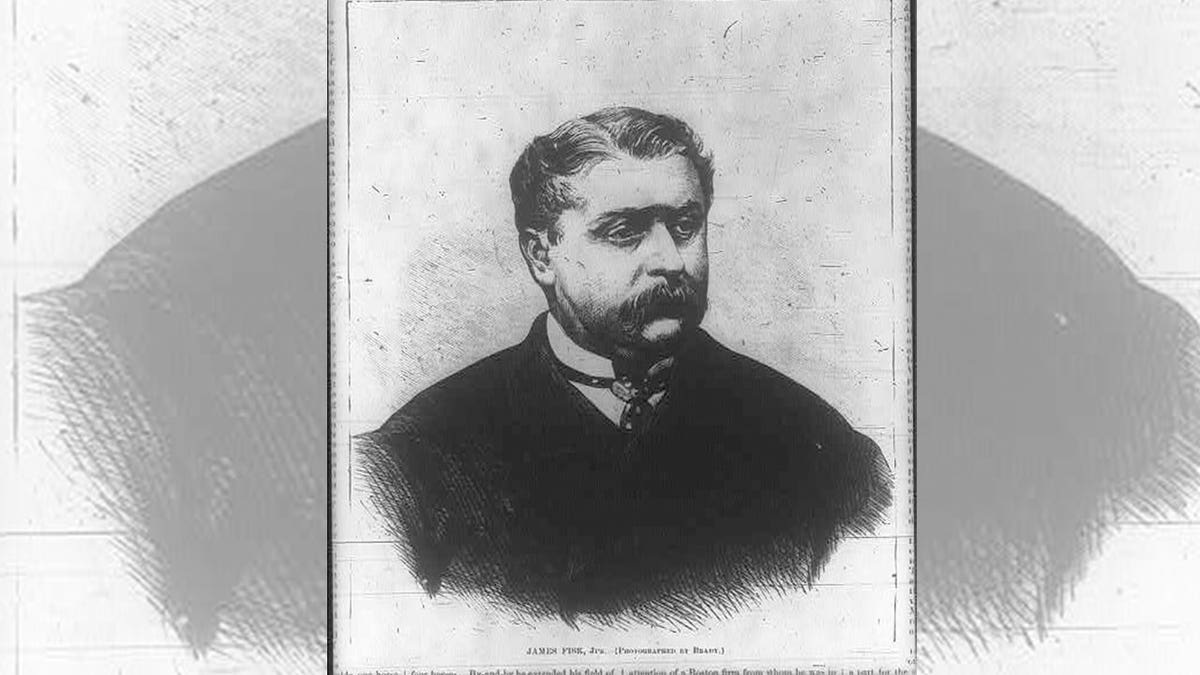

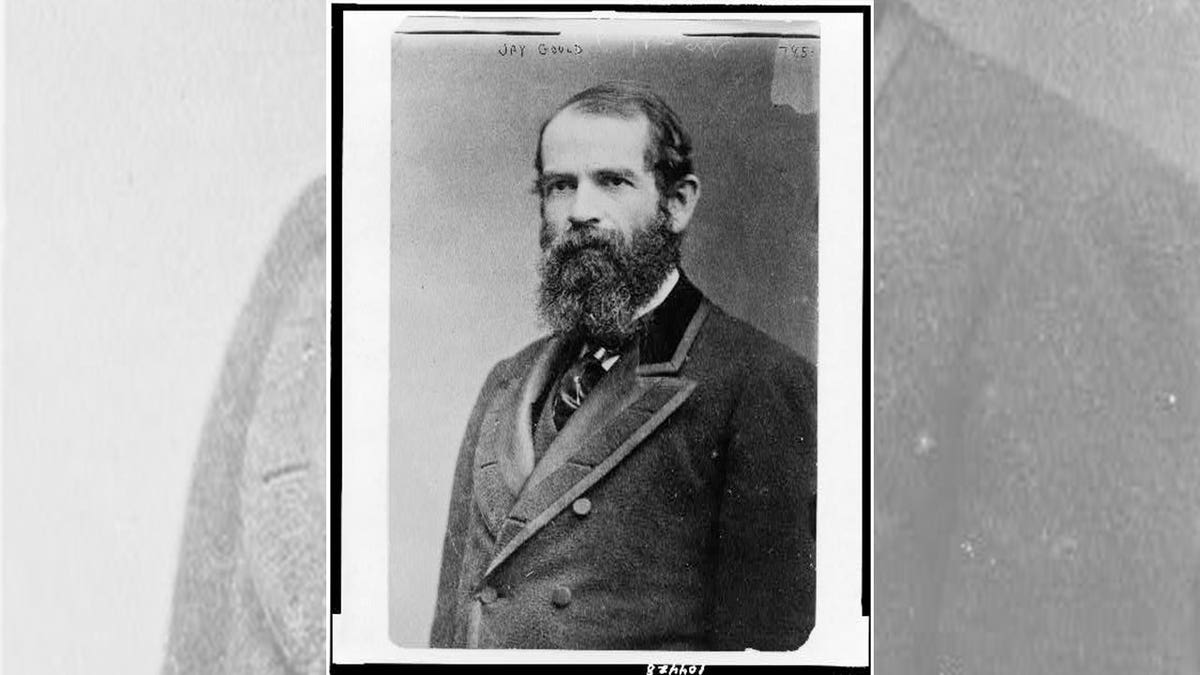

Kuderna added that this event was a “huge financial crime” in history, explaining how two infamous American financiers, Jay Gould and Jim Fisk, concocted a criminal scheme to corner the gold market, leading to widespread panic across the country as many were driven to bankruptcy.

TD BANK’S HISTORIC $3B MONEY LAUNDERING CASE ROCKS FINANCIAL WORLD AS MORE CHARGES POSSIBLE

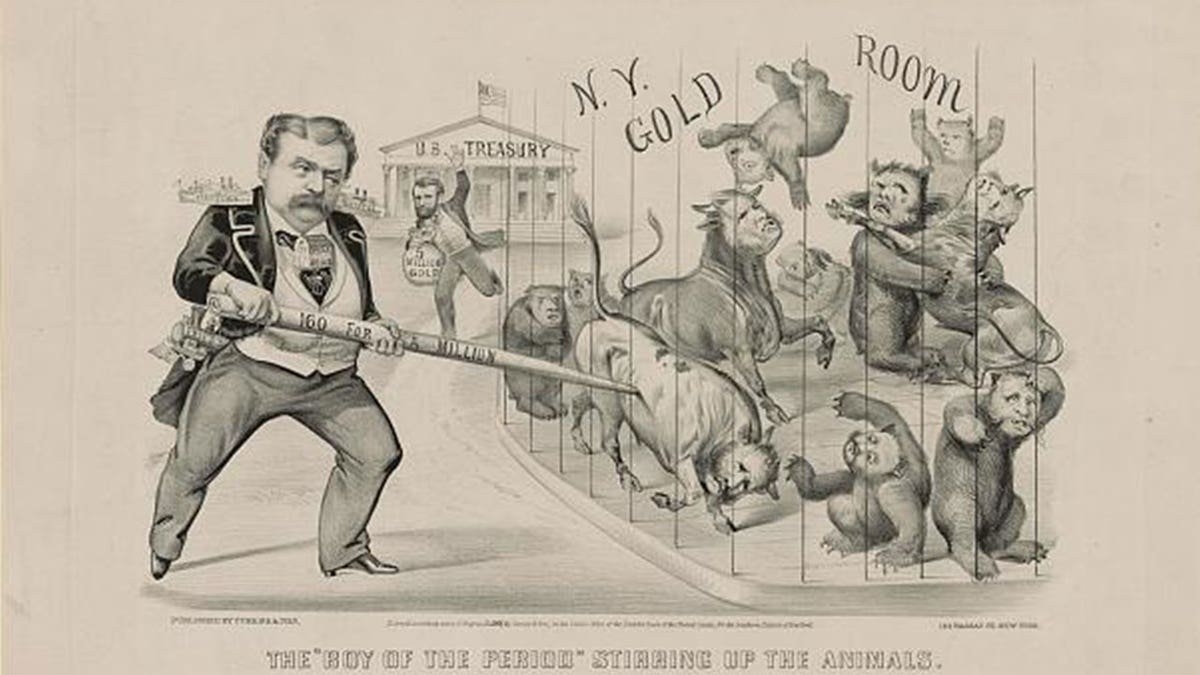

“They were true ‘robber barons’ of the Gilded Age,” Kuderna said. “The gold circulation in the U.S. was roughly $20 million of gold … so Jay Gould and his friend, Jim Fisk, thought about this, and they said, ‘You know what? With a set amount of $20 million of gold in circulation, if some really wealthy people with deep pockets were to go and try and buy up all that gold, they could effectively corner the market.’”

“They both were very wealthy,” Kuderna said. “They had done a lot of shady deals in the past, and they said, ‘You know what? Let’s go out there and buy up all the gold we can and actually corner this market.'”

Gould and Fisk planned to do just that, but they needed a bit of help from someone in the government on the inside.

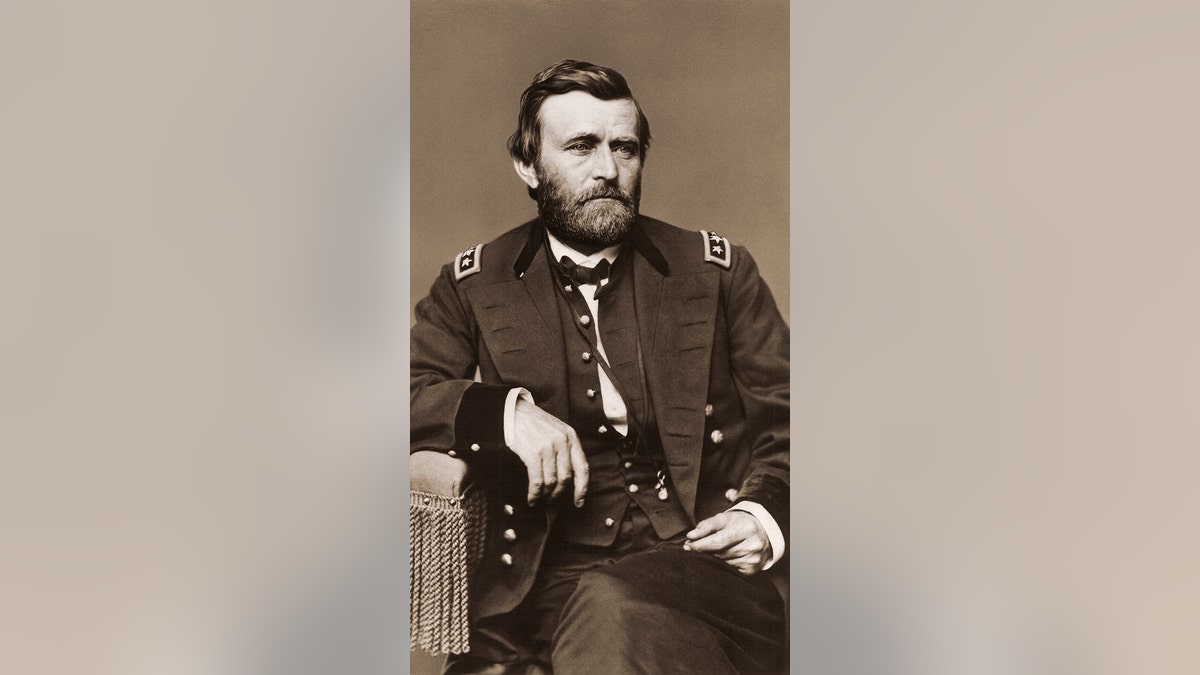

President Ulysses S. Grant planned to release more gold into the economy and limit the amount of greenbacks (paper dollars) in circulation, and this would foil the criminal duo’s plan by driving the price of gold down.

CHINESE MONEY LAUNDERING CRIMINALS TEAM UP WITH MEXICAN CARTELS TO MENACE US, OFFICIALS WARN CONGRESS

“They befriended the president’s brother-in-law, and they let him in on this scheme,” Kuderna said. “They paid them off and said, ‘Can you get in your brother-in-law the president’s ear and try and get an assurance from him that he will not sell any more gold into the market.”

The president listened to his brother-in-law, Abel Rathbone Corbin, and he didn’t release gold into the market for a period of time.

“As a result of controlling the supply and shrinking that supply and concentrating it just to these two individuals, the price of gold skyrocketed,” Kuderna said. “And at this time, Jay Gould and his investing partner, Jim Fisk, went about cornering the market and getting their hands on all the gold that they possibly could.”

MULTIYEAR DEAL INVESTIGATION ACCUSES DRUG CARTEL OF LAUNDERING MILLIONS THROUGH CHINESE NETWORK IN LA

President Grant soon became uncomfortable with his brother-in-law’s interest, believing something “fishy” was going on, and he ordered the sale of millions of dollars in gold, Kuderna said. Meanwhile, Gould and Fisk had started to buy up gold.

On Sept. 24, 1869, the government’s gold hit the market, and the price of gold plummeted almost immediately.

“They flood the market with gold. The price of gold comes crashing down, and at the same time, the price in the stock markets comes crashing down on what is now known as Black Friday,” Kuderna explained.

The stock market crash affected many across the country, and some were even driven to bankruptcy.

The next period of dark history surrounding the term Black Friday began in the mid-20th century in Philadelphia.

“In the 1950s … in between Thanksgiving and what was often the Army-Navy football game on the following Saturday, particularly in Philadelphia where the game was played, the city just got overwhelmed with football fans, tourists and shoppers that were off for the weekend,” Kuderna said. “And this was the time that Philadelphia’s police department was really pushed to the limit that everybody had to be working overtime. They were just at a shortage of manpower … there were a lot of reports of shoplifting, of just stores being completely overwhelmed … and that’s where that term ‘Black Friday’ really started to kind of rear its head.”

Kuderna explained that at this time, retailers changed the term from Black Friday to Big Friday.

“It got rid of a little bit of the negativity, the connotation with that name and made it more about the sales, the excitement of the holiday season and that we’re kicking it off with a Big Friday,” he said. “Frankly, I wish that that term stuck around.”

The more recent background behind the Black Friday term is a financial interpretation that began as it moved past its historically dark origins.

“The most recent knowledge of the term came from the ’80s when accountants of all the major retailers would say, ‘OK, before Thanksgiving, you know, perhaps we were operating in the red, we were operating at a loss, and then on this Friday, after Thanksgiving, we would just have this huge boom in all of our sales.’ And so they would go from operating in the red, at a loss, to in the positive, in the black,” Kuderna said. “That’s the Black Friday that we all know today.”

Despite Black Friday’s evolution into a positive highlight of the year, symbolizing the start of the holiday shopping season, Kuderna noted the importance of understanding the darker history of the day.

“I would love people to be aware of where it actually came from,” he said. “I think it’s important to kind of know where we’ve come from so we don’t make mistakes again.”