New York

Even the power of Marie Kondo may not be enough to save the Container Store.

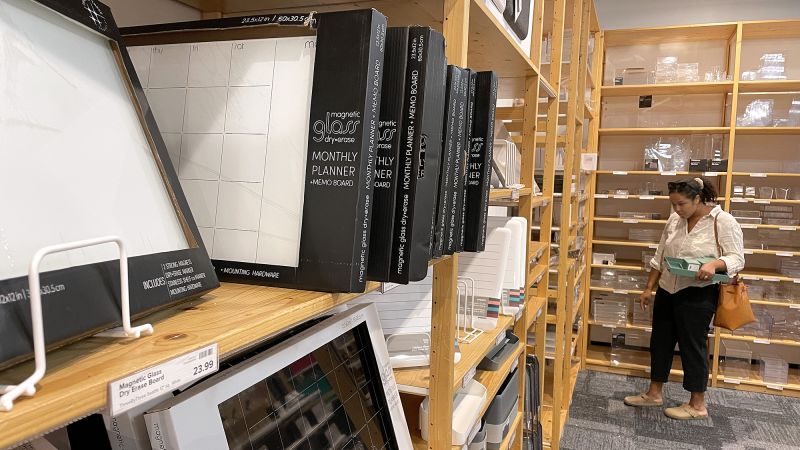

In 2019 and 2020, the Container Store got a big boost from “Tidying Up,” the hit Netflix show from the home de-cluttering evangelist. Customers rushed into stores to buy storage bins, pantry and drawer organizers, shelves and other goods to organize the junk in their homes, helping drive up the company’s sales. The Container Store in 2021 launched a partnership with Kondo to design exclusive products for the chain.

“When ‘Tidying Up’ premiered in 2019 and consumers immediately connected decluttering and organization with The Container Store, we knew that there was an opportunity to create something special with Marie,” the Container Store’s then-CEO Melissa Reiff said in 2020.

But the Kondo effect has worn off, and the Container Store’s future is in jeopardy.

A weak housing market and steep competition have squeezed the chain. The Container Store, which first began in 1978 and has grown to around 100 US locations, now faces a critical holiday shopping season to save it from bankruptcy. Credit rating agencies rank the Container Store as one of the most financially distressed companies in the retail industry.

The Container Store’s struggles show that the bump many retailers got coming out of the pandemic has ended, with retailers now facing a much tougher environment. More stores are expected to close this year than any year since 2020, according to Coresight Research. Chains like LL Flooring, Big Lots and Joann Fabric have filed for bankruptcy in recent months.

There’s a “high probability” the Container Store will join those retailers and file for bankruptcy next year, said Tim Hynes, the global head of credit research at Debtwire, a publication that focuses on distressed companies. “I don’t see any dramatic increase in holiday sales that will change the situation. They are already pretty far down the line.”

The Container Store in May said it would conduct a strategic review of its business to boost its value and suspended its financial guidance. Sales dropped 10.5% during its latest quarter ending September 28, and the company lost $30.8 million during the quarter.

The Container Store had been set to receive a much-needed $40 million financial lifeline from Beyond, the owner of Bed Bath & Beyond and Overstock.com, that would have put Bed Bath & Beyond products on Container Store shelves. But Beyond said last week that the financing deal was in doubt because the Container Store was struggling to reach an agreement with its lenders.

The Container Store did not respond to ’s requests for comment.

The Container Store has slumped since it was riding high in 2021, when consumers stuck inside their homes at the peak of the pandemic drove record sales and profit.

The company is vulnerable to changes in the housing market. Mortgage rates hit two-decade highs near 8% last year and are still hovering close to 7%. High interest rates have kept many people from buying or selling their homes, and the frozen housing market has spilled over to hurt the Container Store.

“When people move, they buy a heck of a lot of things related to storage and organization. Without this impetus, Container Store has struggled,” Neil Saunders, an analyst at GlobalData Retail, told . “The weakening of the housing market has pushed down demand for most of the products the Container Store sells.”

Consumers hunting for bargains and dialing back discretionary purchases after years of companies raising prices has also pressured the Container Store, as well as competitors like Target. Target’s home goods sales dropped last quarter as “consumers continue to spend cautiously,” the company said this month on an earnings call.

The Container Store has never been known for having the lowest prices, analysts say. Instead, it has stood out by being an authority for customers when they need advice on home organizing or want custom closest spaces.

“There will always be a cheaper alternative to a plastic bin. Our objective is not to compete there because we don’t have the scale and buying power to do so,” Container Store CEO Satish Malhotra said in a July interview with ModernRetail. “It’s a bit of a white glove experience we offer.”

But the Container Store’s core middle-income shoppers are looking for discounts more than the consultations and premium services the chain can offer. Even more affluent shoppers are curtailing their spending and switching to chains that offer lower-priced products. Walmart said last quarter that it has been gaining market share with customers making more than $100,000 a year.

“Most households want cheap solutions, and Container Store delivers relatively expensive solutions,” Saunders said. “That’s out of kilter with where the consumer is right now.”

Instead of the Container Store, customers are buying similar products from Amazon, Walmart and HomeGoods for lower prices, as well as online retailers like Temu. “The rise of platforms like Temu have given consumers some much cheaper options for the type of products Container Store sells,” Saunders said.

Holiday shopping likely won’t be strong enough to prop up the Container Store, analysts say.

Moody’s Investors Service predicts overall holiday sales will grow just 1% to 3%, a slowdown from last year. Sales may be weaker for home furnishings, pressuring companies like the Container Store, Wayfair and Floor & Décor, said Christina Boni, a retail analyst at Moody’s.

“The home goods category has been a difficult category to be in,” she said. “It’s not going to be a great home goods holiday.”